By Anthony Areh

The Fiscal Responsibility Commission on Wednesday, urged State government to implement the fiscal responsibility Act, 2007 for accountability and transparency.

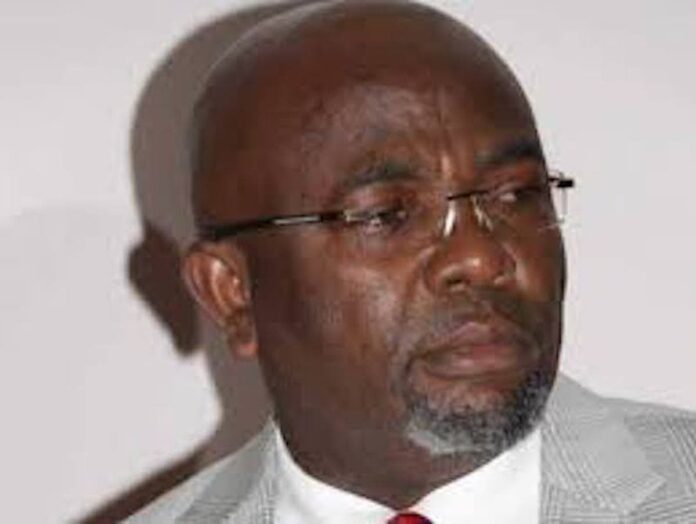

Mr. Victor Muruako, the Acting Chairman of the Commission, disclosed this during a one-day workshop organized by the Commission in collaboration with CISLAC and OXFAM in Port Harcourt.

Muruako said that the workshop with the theme “Policy Framework For Strengthening Fiscal Transparency, Prudence and Accountability at Sub-National was to ensure effective implementation of the fiscal Act, 2007 at the federal and state levels in the country.

He said that the retreat was to identify gaps and institutional challenges among other issues that have weakened the capacity of fiscal responsibility

initiatives at the sub-national level to effectively execute the mandate.

“We are glad to report that there is a growing commitment to transparency and accountability at all levels, though gradually, we have got a number of the states to embrace this culture.

“Presently, 17 states have passed the law and set up their fiscal responsibility agencies.

“We call on other states to buy into this project to enable them run their services without waiting for the monthly federal allocations to run their states,”he said.

Muruako stated that the Commission would henceforth check on commercial banks that grant loans carelessly to some sub-national governments without approval from the commission as required by the fiscal responsibility Act.2007.

“He said that such loans henceforth must follow due process or the Commission will have no option than to invoke the provision of the law against the erring entity.

Mr. Auwal Ibrahim Rasfanjani, the Executive Director Civil Society Legislative Advocacy Centre, (CISLAC) said that the group is fully in support of the mandate of the fiscal responsibility commission to ensure transparency and accountability and reduce losses alleged in the country through public institutions.

Rasfanjani stated that the unbridled borrowing culture at all levels of government as well as incapacity of the regulator to use hammer of sanction to defaulters, and a clear evidence of misappropriation of public funds by public office holders would ruin the economy of the country.

“It does not make sense that we borrow recklessly and also spend recklessly, it is not in any way to our best interest as a country,” he said.

Furthermore, Mr. Henry Ushie, the Lead EveniT Up Campaign, representing the Country Director of OXFAM, Mr Constant Tchona, urged government at all levels to look inward and harness the mineral resources in their states than waiting for the monthly allocations from the centre.