e-Naira: Challenges of adoption, potential benefits

By Usman Aliyu

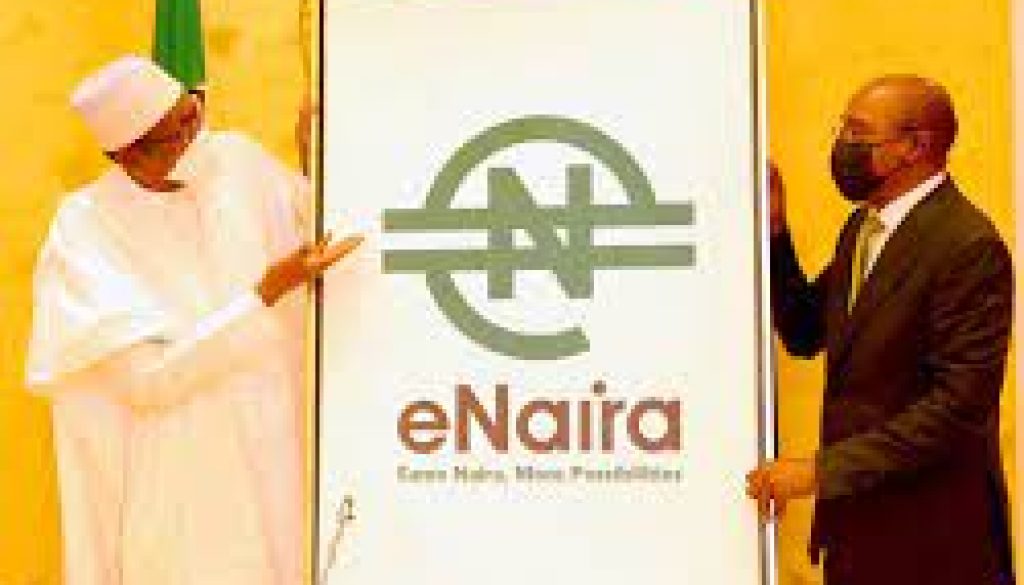

The launch of e-Naira in Nigeria on Oct. 25, 2021 marked a significant milestone toward positioning the country as a pioneer in Africa’s digital currency landscape.

Mr Godwin Emefiele, then Governor of the Central Bank of Nigeria (CBN), had explained then that the digital currency was expected to complement the traditional Naira while offering a range of benefits, including cost-efficiency, enhanced monetary policy effectiveness, and improved financial inclusion.

Notwithstanding these potential advantages, the e-Naira has continued to face acceptance and adoption challenges, more than two years after the currency was officially launched.

Financial experts attribute the reluctance to embrace the e-Naira among Nigerians to the inherent skepticism and concerns surrounding digital currencies and their impact on the economy.

Mr Yinka Rabiu, a director at the Ilorin branch of the CBN, says the concept of digital currencies is relatively new to many individuals, and there is a natural hesitancy to trust a system that operates solely in the digital realm.

Additionally, he says there is a lack of understanding among the general public about the operational mechanisms and security features of the e-Naira, leading to apprehensions about potential risks and vulnerabilities.

“First, it is a new innovation and we need to do more awareness for people to understand the need to change to e-Naira.

“Similarly, commercial banks are not happy with e-Naira because it is free of transaction charges.

“While little merchants are unbothered, market women have little knowledge on it and rural area without network or smart phone can not have access unless using USSD *997#,” says the senior CBN official.

Corroborating, Mr Femi Babatunde, a financial expert, said that the digital currency represents a fundamental shift in currency which promises the convenience of digital money with the reliability of government backing.

“Its significance lies in the potential to modernise financial systems and streamline transactions, marking the next step in the evolution of money.

“Digital currencies stand to revolutionise the financial landscape by enhancing liquidity flow and streamlining banking operations. The advantages they offer extend to cross-border transactions, reducing costs and time involved,” he says.

A widespread adoption, he notes, could drastically improve financial inclusivity and efficiency, transcending traditional banking models.

Furthermore, he avers that the broader technological infrastructure in Nigeria presents a significant hurdle to the widespread adoption of the e-Naira.

According to this expert, limited internet connectivity, particularly in rural areas, poses a challenge for individuals who may not have consistent access to the internet or smartphones, which are often essential for digital currency transactions.

He explains that enhancing the technological infrastructure to support a seamless transition to digital currency is crucial for overcoming this barrier to adoption.

But for Mr Jude Osunbunmi, an entrepreneur, low enlightenment and serious security concerns contribute to the hesitancy surrounding the e-Naira.

With the increasing prevalence of cyber threats and fraudulent activities, he says he is apprehensive about the security of the digital assets and the potential vulnerabilities of the e-Naira system.

Osunbunmi asserts that addressing these concerns through robust security measures and educational initiatives is essential for building trust and confidence in the e-Naira among the public.

Despite these challenges, Rabiu, the CBN director, says there are numerous benefits that the public is missing by not embracing the e-Naira.

Besides the fact that the e-Naira presents the CBN an opportunity to enhance the effectiveness of monetary policy and streamline the government’s capacity to deploy targeted social interventions, Rabiu says it holds the promise of expanding financial inclusion and providing access to formal financial services.

“This is especially critical in a country where a sizable portion of the population remains excluded from the traditional banking system.

“By enabling individuals to transact digitally and access a range of financial services, the e-Naira has the potential to empower marginalised communities and stimulate economic growth,” says the CBN official.

Sharing a similar sentiment, Mr Ben Eze, who is a financial advisor, observed that the adoption of the e-Naira could offer Small and Medium-sized Enterprises (SMEs) greater access to a broader customer base, streamline their financial operations, and reduce the reliance on cash transactions, thereby enhancing efficiency and transparency.

To address the barriers to adoption and maximising the benefits of the e-Naira, Eze advocates collaboration among various stakeholders is paramount.

“The CBN, in partnership with financial institutions, technology providers, and other relevant entities, must prioritise educational initiatives to enhance public awareness and understanding of the e-Naira.

“By demystifying digital currencies and elucidating their potential advantages, the misconceptions and skepticism surrounding the e-Naira can be mitigated.

“Moreover, investments in enhancing the technological infrastructure are imperative to ensure equitable access to digital currency transactions across urban and rural areas.

“This necessitates strategic partnerships with telecommunications companies and internet service providers to expand connectivity and promote digital inclusivity,” says the financial advisor.

For many analysts, the e-Naira represents a transformative opportunity for Nigeria to modernise its financial landscape, drive inclusive economic growth, and foster innovation in the digital economy.

They note that while the challenges of adoption are significant, the potential benefits of the e-Naira are equally compelling.

They agree that through collaborative efforts among stakeholders, proactive measures to address concerns and targeted initiatives to enhance accessibility and usability, the e-Naira can pave the way for a more inclusive, efficient, and resilient financial ecosystem in Nigeria.