CBN issues guidelines on currency swap deal

The Central Bank of Nigeria (CBN) on Thursday released

guidelines for the bilateral Currency Swap agreement between Nigeria and China.

guidelines for the bilateral Currency Swap agreement between Nigeria and China.

The CBN gave the guidelines in a document signed by the

Director, Financial Markets Department, Dr Alvan Ikoku and posted on its

website.

Director, Financial Markets Department, Dr Alvan Ikoku and posted on its

website.

The regulator, in document titled, “Regulations for Transactions

with Authorised Dealers in Renminbi,” said it might conduct bi-weekly trading

sessions to ensure liquidity for trade and direct investment between the two

countries.

with Authorised Dealers in Renminbi,” said it might conduct bi-weekly trading

sessions to ensure liquidity for trade and direct investment between the two

countries.

The Apex bank in the guidelines mandated commercial banks and

merchant banks, authorised dealers to open Renminbi bank accounts and provide

details to the CBN.

merchant banks, authorised dealers to open Renminbi bank accounts and provide

details to the CBN.

The CBN said, “All Authorised Dealers shall open Renminbi accounts

with a corresponding bank and advise CBN with its Renminbi Account details

which may either be with a bank onshore or offshore China.

with a corresponding bank and advise CBN with its Renminbi Account details

which may either be with a bank onshore or offshore China.

“Importers intending to import from China shall obtain Proforma

invoice denominated in Renminbi as part of the documents required for the

registration of Form M.

invoice denominated in Renminbi as part of the documents required for the

registration of Form M.

“FX purchase in the window shall not be used for payments on

transactions in which the beneficiaries are not in China.

transactions in which the beneficiaries are not in China.

“Authorised Dealers shall not open domiciliary accounts

denominated in Renminbi for customers.”

denominated in Renminbi for customers.”

The CBN, however, said the deal would not stop levies on imports

and exports, while unused funds by authorised dealers more than 72 hours would

be returned to the apex bank for repurchase at the bank’s buying rate.

and exports, while unused funds by authorised dealers more than 72 hours would

be returned to the apex bank for repurchase at the bank’s buying rate.

It added that authorised dealers might not earn more than 50

kobo in a customer’s bid.

kobo in a customer’s bid.

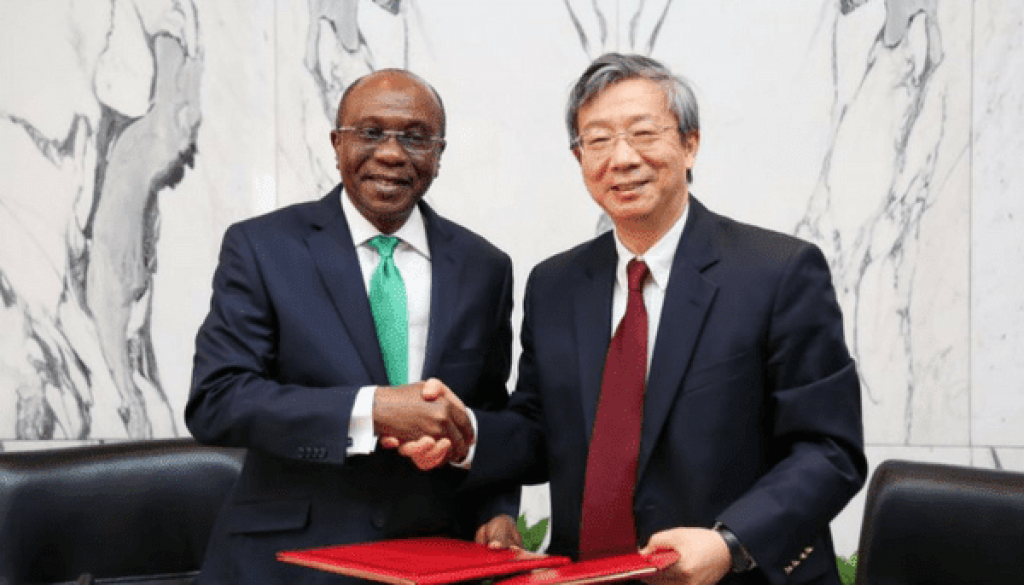

The CBN on May 3 signed a bilateral Currency Swap agreement with

the People’s Bank of China (PBoC) worth about $2.5billion. In local currencies,

the swap is worth 15billion Renminbi (RMB) or N720billion.

the People’s Bank of China (PBoC) worth about $2.5billion. In local currencies,

the swap is worth 15billion Renminbi (RMB) or N720billion.

The deal is expected to reduce the demand for US dollar by

Nigerians importing goods from China, and consequently strengthen the value of

the Naira.

Nigerians importing goods from China, and consequently strengthen the value of

the Naira.

The deal will reduce certain barriers for Nigerian importers of

goods from China as well as the cost of transactions in multiple currencies.

goods from China as well as the cost of transactions in multiple currencies.