Can government tame Naira’s volatility?

The depreciation of the Naira against major international currencies has been a major concern for both Nigerians and the government in 2023.

This volatility in the Naira has had a significant impact on the overall economy and has put pressure on foreign reserves.

Having an unstable currency like the Naira hampers economic planning, discourages investment, and fuels inflation, ultimately affecting ordinary Nigerians.

Therefore, the pursuit of a stable Naira remains a top priority for the government.

To address the issue of Naira instability, the government has implemented various strategies through the Central Bank of Nigeria(CBN).

It came up with fixed exchange rates and adopted a managed floating regime to strike a balance between stability and flexibility, aiming to free the Naira.

However, achieving a stable exchange rate is crucial, as it fosters confidence, encourages trade, and attracts foreign investment, paving the way for sustainable economic growth.

It is important for all stakeholders to work together and address the underlying factors contributing to the Naira’s volatility to build a more resilient economy.

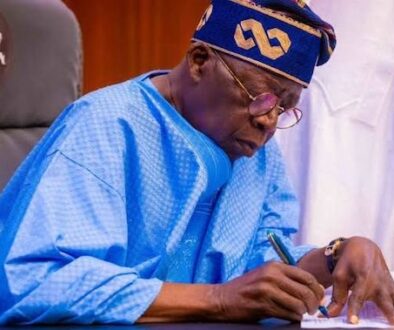

President Bola Tinubu, while presenting the 2024 budget to the National Assembly, set the exchange rate between the Naira and the U.S. dollar at N750 to a dollar.

Analysts said that to control the Naira unpredictable instability, concerted efforts were required from all stakeholders to address the underlying factors contributing to its volatility and to build a more resilient economy.

Reacting, the Chief Executive Officer, Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said that for any government to truly control Naira unpredictable, a comprehensive step must be taken to address the issue.

Yusuf acknowledged that the CBN was currently implementing a new market-based approach in managing the foreign exchange market, which is perceived as more efficient and transparent.

He said that this had led to a weaker Naira currency but noted that the situation could improve over time.

According to Yusuf, the success of this new approach will rely on its ability to attract foreign investment, promote economic growth, and effectively manage inflation.

He, however, said that the government decision to officially adopt a new exchange rate of N750 per dollar for 2024 could have positive and negative consequences for the economy.

According to him, the current exchange rate is more realistic and reflects the true value of the currency, as well as government efforts to eliminate foreign exchange subsidies.

The economist said that the development had resulted in increased government revenue, as the conversion of dollar earnings at N750 is more favourable compared to the previous rates.

He explained that the major advantage of the new exchange rate is its positive impact on government revenue.

“Unlike what was used before, the current exchange rate, as it is used, is more realistic and reflects the market situation-the true value of the currency of the exchange rate.

“More importantly, the attempt to eliminate the foreign exchange subsidy that has existed before has helped to increase government revenue.

“So, these are some of the major advantages that this new exchange rate will bring to the economy and the government; there will be major revenue advantages.

“Can you imagine when we were converting our dollar earnings at N450? You can imagine what it was under the previous government compared to the dollar earnings at N750 to a dollar.

“You can see that the revenue implication is huge. So, there’s a major revenue advantage,’’ he said.

He noted that challenges encountered during previous attempts to manage the exchange rate included corruption and a large difference between the official rate and the parallel market rate.

According to him, such discrepancies create incentives for round-tripping and hinder economic stability.

“The premium between the official rate and the parallel market rate was very high; getting close to almost 100 per cent. You can’t run an economy that way such that you now create incentives for people to now be round tripping.

“So, there’s a major problem of corruption and round-tripping that the previous foreign exchange regime created.

`Secondly, it lacked transparency because we didn’t know who was getting what and what the criteria for the allocation was. This eroded public trust and confidence in the financial system, among others.’’

Ndubisi Nwokoma, Professor of Financial Economics and Director of the Centre for Economic Policy Analysis and Research (CEPAR), University of Lagos, stated that adopting a particular exchange rate for the country at any time, fiscal policy was easy to do.

“But the question is, can the government fund the foreign exchange market to sustain the rate? That is the million dollar question.

“The sustainability of N750 to a dollar exchange rate will depend on the efficient management of both the supply and demand forces in the market.

“Currently the Investor and Exporters rate is in the region of N880 to the dollar and bringing it down to N750 will require some great effort by government to beef up supply through remittances, export proceeds and other foreign capital inflows,’’ he said.

Nwokoma said at present, foreign capital inflows to Nigeria are largely not good enough, noting that there is also the demand management dimension which according to him, work needs to be done in these areas.