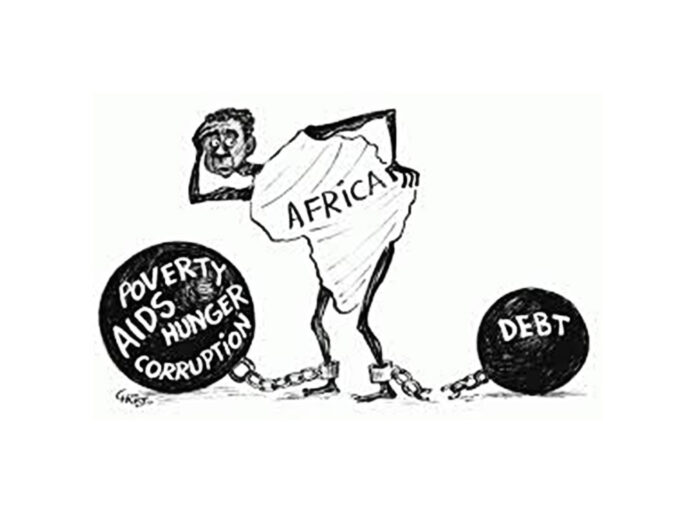

Multilateral lenders account for 35 per cent of Africa’s total external debt, 32 per cent by private lenders.

China accounts for 20 per cent of the debt of the continent and 12 per cent by other governments.

Africa’s external debt payments doubled between 2015 and 2017, the highest level since 2001.

According to research by financial pressure group Jubilee Debt Campaign, repayments grew to 11.9 per cent in 2017 from 5.9 per cent of their revenue in 2015.

This was fuelled by an increase in loans from multiple lenders, a fall in commodity prices, and a rising dollar value.

The interest rates tend to be higher on private-sector loans, which account for 55 per cent of interest payments, compared with China’s 17 per cent.

Tim Jones, an economist at the Jubilee Debt Campaign, said that debt problems are worsening on the African continent due to opaque deals.

“We need new rules to make all lenders publicly disclose loans to governments at the time they are given.

“Furthermore, the International Monetary Fund needs to stop responding to debt crises by giving loans that bail out other lenders, from China to Western companies, incentivising them to continue lending recklessly. Instead, lenders need to be made to restructure and reduce debts,” Mr Jones said.

Data from the World Bank shows $130 billion of African debt is owed to other governments. Under this calculation, $72 billion is owed to China, with $40 billion owed to the Paris Club.

This leaves $18 billion owed to other governments, such as those in the Middle East. African governments made $12.8 billion payments to other governments in 2016, in principal and interest, which is 38 per cent of total external debt payments.

According to the financial campaigners, the continent’s heaviest debt load comes from private lenders, with $13.2 billion paid to private creditors (40 per cent), and $7.3 billion to multilateral institutions (22 per cent), making total external debt payments of $33.3 billion.

China, which has recently received flak for its debt policy on Africa, is actually not in the league of top creditors of the continent.

“Recent news reports have claimed that China is responsible for causing new debt traps on the African continent. The new figures show that China’s role as a lender on the continent has indeed been growing, but its relative importance is less than often stated, especially in regard to countries currently in debt crisis,” the financial campaign group said in its report.

Of the 16 African countries rated by the IMF as in debt distress or at high risk of becoming so, on average 15 per cent of their debt is owed to China.

“China is therefore on average a less significant lender in debt crisis countries, than across the whole continent,” the Jubilee Debt Campaign said.

Source: East Africa

http://www.theeastafrican.co.ke/business/China-not-among-Africa-top-creditors/2560-4808108-cq9bcr/index.html

Multilateral, private lenders account 67% of Africa’s debt

RELATED ARTICLES