As

investors brace for another escalation in a trade war between the

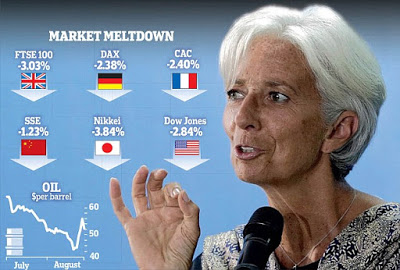

United States and China, World shares recorded a fall for the fifth

straight day on Thursday.

investors brace for another escalation in a trade war between the

United States and China, World shares recorded a fall for the fifth

straight day on Thursday.

Reuters reports that Emerging market (EM) currencies also paused near 15-month lows.

The

MSCI All-Country World Index, which tracks shares in 47 countries, was

down 0.2 per cent. Stocks in Europe opened lower, with the pan-European

STOXX 600

index as much as 0.4 per cent down.

MSCI All-Country World Index, which tracks shares in 47 countries, was

down 0.2 per cent. Stocks in Europe opened lower, with the pan-European

STOXX 600

index as much as 0.4 per cent down.

The

main worry for investors was the end of a public consultation period on

Thursday for U.S. President Donald Trump’s plan to impose tariffs on an

additional

$200 billion of Chinese goods.

main worry for investors was the end of a public consultation period on

Thursday for U.S. President Donald Trump’s plan to impose tariffs on an

additional

$200 billion of Chinese goods.

Trump said on Wednesday trade talks with China would continue but the United States was not yet ready to come to an agreement.

“Unlike

the last few days, where there has at least been a wave of PMI

(purchasing manager indexes) to deal with, Thursday has little in the

way of distraction

for the European markets, meaning investors are just going to have to

sit and stew in this particularly unpleasant trading broth,” said Connor

Campbell, an analyst at Spreadex.

the last few days, where there has at least been a wave of PMI

(purchasing manager indexes) to deal with, Thursday has little in the

way of distraction

for the European markets, meaning investors are just going to have to

sit and stew in this particularly unpleasant trading broth,” said Connor

Campbell, an analyst at Spreadex.

Earlier

in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan

dropped more than 1 percent to a one-year trough of 515.24 points. It

was last down

0.8 percent.

in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan

dropped more than 1 percent to a one-year trough of 515.24 points. It

was last down

0.8 percent.

Japan’s

Nikkei slipped 0.4 percent and Australian shares dropped 1.1 percent.

China’s blue-chip index fell 1.1 percent, Hong Kong’s Hang Seng index 1

percent.

Nikkei slipped 0.4 percent and Australian shares dropped 1.1 percent.

China’s blue-chip index fell 1.1 percent, Hong Kong’s Hang Seng index 1

percent.

Further

weighing on sentiment, data out earlier showed German industrial orders

fell unexpectedly in July, another sign that factories in Europe’s

largest economy

are feeling the bite of protectionist trade politics.

weighing on sentiment, data out earlier showed German industrial orders

fell unexpectedly in July, another sign that factories in Europe’s

largest economy

are feeling the bite of protectionist trade politics.

Investors

are also watching for developments as the United States and Canada

resume talks about revamping the North American Free Trade Agreement.

Canada insisted

there was room to salvage the pact despite few signs a deal was

imminent.

are also watching for developments as the United States and Canada

resume talks about revamping the North American Free Trade Agreement.

Canada insisted

there was room to salvage the pact despite few signs a deal was

imminent.

The

dollar, considered a safe haven at times of turmoil because of its

status as the world’s reserve currency, has generally benefited from the

trade conflicts.

It has gained 8 percent since the end of March, with currencies in

emerging markets taking a hammering.

dollar, considered a safe haven at times of turmoil because of its

status as the world’s reserve currency, has generally benefited from the

trade conflicts.

It has gained 8 percent since the end of March, with currencies in

emerging markets taking a hammering.

But

measured against a basket of currencies, the dollar retreated from the

two-week highs it reached earlier this week to stand 0.1 percent lower

at 95.07.

measured against a basket of currencies, the dollar retreated from the

two-week highs it reached earlier this week to stand 0.1 percent lower

at 95.07.

The euro was a tad stronger at $1.1636.

Sterling

held on to gains made on Wednesday as investors positioned for a

favorable Brexit outcome. It was last up 0.1 percent at $1.2910.

held on to gains made on Wednesday as investors positioned for a

favorable Brexit outcome. It was last up 0.1 percent at $1.2910.

Emerging

markets have been hit by the financial crises in Argentina and Turkey.

In Indonesia’s central bank has had to intervene several times in recent

weeks

to stem the rupiah’s slide.

markets have been hit by the financial crises in Argentina and Turkey.

In Indonesia’s central bank has had to intervene several times in recent

weeks

to stem the rupiah’s slide.

Indonesia’s benchmark stock index was last up nearly 1 percent while the rupiah also gained a tad.

MSCI’s

index of emerging market currencies, which had earlier paused near

15-month lows, was up 0.1 percent on the day after two straight days of

heavy declines.

index of emerging market currencies, which had earlier paused near

15-month lows, was up 0.1 percent on the day after two straight days of

heavy declines.

But

analysts warned about further losses because investors were no longer

looking at Argentina, Turkey and South Africa as isolated cases. They

were fretting

over the impact of rising U.S. inflation and interest rates on heavily

indebted economies.

analysts warned about further losses because investors were no longer

looking at Argentina, Turkey and South Africa as isolated cases. They

were fretting

over the impact of rising U.S. inflation and interest rates on heavily

indebted economies.

“As

global monetary conditions slowly tighten, the global economic cycle

rolls over and the U.S. President disturbs the global trade cycle,

there’s definitely

more to the EM sell-off than a few unrelated spots of weakness,” wrote

strategists at Societe Generale in a note to clients.

global monetary conditions slowly tighten, the global economic cycle

rolls over and the U.S. President disturbs the global trade cycle,

there’s definitely

more to the EM sell-off than a few unrelated spots of weakness,” wrote

strategists at Societe Generale in a note to clients.

The

emerging market equity index has been crunched in the past month or so,

falling for six consecutive sessions and down more than 3 percent this

week.

emerging market equity index has been crunched in the past month or so,

falling for six consecutive sessions and down more than 3 percent this

week.

A

range of factors have hit the stocks: policy tightening by the U.S.

Federal Reserve, the crises in Turkey and Argentina, the Sino-U.S. trade

war and broader

concerns about China’s economy.

range of factors have hit the stocks: policy tightening by the U.S.

Federal Reserve, the crises in Turkey and Argentina, the Sino-U.S. trade

war and broader

concerns about China’s economy.

“We

doubt that the main factors which have caused equities across much of

the emerging world to weaken together recently will go away just yet,”

Capital Economics

said in a note.

doubt that the main factors which have caused equities across much of

the emerging world to weaken together recently will go away just yet,”

Capital Economics

said in a note.

In

commodities, oil prices fell as emerging market woes weighed on

sentiment. U.S. crude eased 0.1 percent to $68.65 a barrel. Brent was

last down 0.1 percent

at $68.64.

commodities, oil prices fell as emerging market woes weighed on

sentiment. U.S. crude eased 0.1 percent to $68.65 a barrel. Brent was

last down 0.1 percent

at $68.64.

Gold was stronger with spot gold up half a percent at $1,202.15 an ounce.