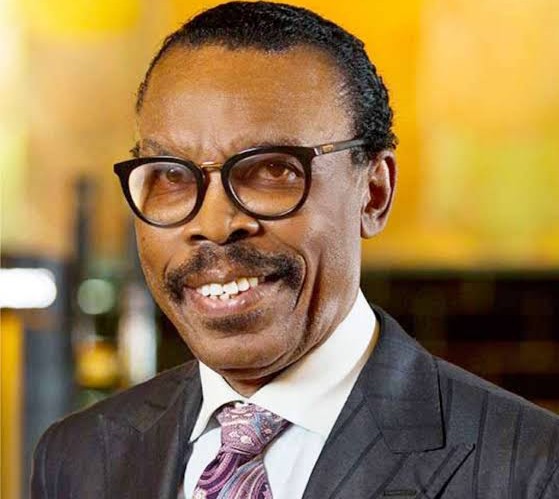

Mr Bismarck Rewane, Chief Executive Officer, Financial Derivatives, has pegged Nigeria’s economic growth for 2022 at 3.4 per cent.

Rewane made the forecast at the Nigerian-British Chamber of Commerce (NBCC) January Breakfast Meeting with the theme: “2022 Economic Outlook” on Thursday in Lagos.

Rewane based the projection on the success and high level of productivity in key sectors such as Information and Communication Technology (ICT) and financial services.

He, however, projected that the country’s inflation rate was expected to remain structurally high with a full year average of 13.3 per cent.

The economist explained that the development would be driven by cost push factors such as fuel subsidy removal, electricity tariff and taxation.

He said the country’s Gross Domestic Product (GDP) rate would also be revised upwards to 2.8 per cent from its current 2.1 per cent premised on improvements in services and manufacturing sector.

He stated that urgent policy actions were required in four areas: reducing inflation, catalysing private investments, addressing fiscal pressure and eliminating fuel subsidy.

“Nigeria would be richer and better off in 2022 and key sectors to drive the expected growth are ICT and the financials because other sectors use it to drive productivity.

“However, whilst they push productivity, they also lead to displacement of jobs.

“There has been a 90 per cent surge in electronic payment, e-commerce, digitalisation and technology.

“2022 would also see sustained inflation as basic products such as medications, food have increased by over 100 per cent while real GDP growth would be sublime,” he said.

Rewane said Nigeria’s gross external reserves would decline towards 39 billion dollars as the Central Bank of Nigeria (CBN) increased foreign exchange supply and allowed Naira convergence.

He added that government would increase borrowing to meet deficit financing needs and may result in sovereign debt default.

In the business space, Rewane said there would be new initiatives and opportunities in the retail business, with new frontiers opening up in Fintech.

He added that massive opportunities existed in aviation and construction sectors.

“There would be increased investments by existing players to raise entry barriers and competition within certain industries,” he said.

For the country’s monetary policy outlook, Rewane said CBN’s policy directions would be influenced by global development, which would result to Monetary Policy tightening in 2022.

“The Apex bank will continue with the adoption of the crawling peg strategy in a shift towards greater exchange rate flexibility,” he said.

Rewane noted that fiscal policy would be impeded by political considerations and labour union activities.

“After all the thearetrics, we are going to have a situation where it is in the best interest of Nigeria for subsidy removal or reduction, while holding government responsible for what is done with the revenue.

“I believe that there would be some arrangements or agreement to gradually remove the subsidies to reduce the incentives to smuggle and increase government revenue accompanied by a demand for accountability and good governance beneficial to Nigerians.

“The twitter ban lift is also good as it means open market communication which leads to information and brings competency,” he said.

Mrs Bisi Adeyemi, president, NBCC, said the major objective of the event was to conduct a vigorous and comprehensive assessment of this year’s economic outlook.

This, she said would point out the threats and opportunities for businesses in Nigeria.

“This event is in alignment with our cardinal mandate as a chamber and our commitment to upscale the value proposition for members and all our stakeholders,” she said.

Mr Ben Llewellyn-Jones, British Deputy High Commissioner to Nigeria, reiterated the United Kingdom’s commitment to supporting trade and investment in Nigeria.

“We are interested in growing diversity of several sectors such as the creative sector among others and are trying to unblock obstacles that make trading difficult between both countries,” he said.