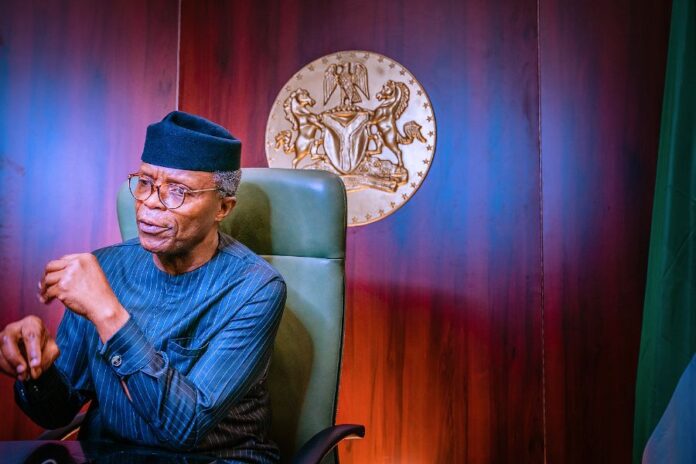

Nigeria’s Vice President Yemi Osinbajo has urged leaders of destination countries to insist on repatriation of illicit funds and proceeds.

Osinbajo’s spokesman, Laolu Akande, in a statement on Monday in Abuja, said the Vice President made the submission at the virtual inauguration of a publication by the UN Conference on Trade and Development (UNCTAD) on the impact of illicit financial flows (IFFs) on African Development.

Osinbajo called for an overhaul of the international tax system in order to tackle the scourge.

“The enormity of efforts required to tackle illicit financial flows is evident in the many dimensions the scourge presents itself.

“It manifests through harmful tax policies and practices, abusive transfer pricing, trade mis-pricing and mis-invoicing illegal exploitation of natural resources as well as official corruption, and organized crimes.

“We have to pay particular attention to efforts to reform the international tax system.

“The commercial form of illicit financial flows, especially tax evasion and aggressive tax avoidance accounts for up to 65 per cent of illicit financial flows.

“This means that we must pay particular attention to these issues, which are aided by things such as tax treaties, tax havens, and financial secrecy jurisdictions and indeed tax competition which leads to a ‘race to the bottom’ in terms of tax rates amongst developing countries.”

He said that another important issue that must receive attention was the identification and return of proceeds of illicit financial flows back to countries of origin as an effective deterrent to the scourge of illicit financial flows.

According to him, exposing those involved in practices that facilitate illicit financial flows, and retrieving proceeds of illicit funds are efficacious in deterring perpetrators, rebuilding the confidence of the citizenry, and compensating for the damage caused by such crimes.

“I encourage all leaders, whose countries are considered absolute outliers for illicit financial flows, to join forces and take the responsibility of combating the scourge by insisting on the repatriation of illicit funds and their proceeds.

“Let me also avail myself of this opportunity to call on leaders, whose countries are the main destinations for illicit financial flows, to take concrete steps to prevent and stop the receipt of illicit funds into their countries, and to assist in freezing, seizing, and returning such funds and its proceeds already in their countries.”

On the way forward, the Vice President called for cooperation and synergy among the private sector, civil society, trade unions and professional groups to work with governments in tackling illicit financial flows.

He appreciated the immediate past President of the United Nations General Assembly, Prof. Tijjani Muhammad-Bande, and Amb. Mona Jul of the Economic and Social Council (ECOSOC), for taking the initiative to establish the first global Financial Accountability, Transparency and Integrity Panel (FACTI Panel)

Osinbajo called on the UN system to facilitate the establishment of clear rules and enforcement mechanisms on all aspects of illicit financial flows.

Making reference to the Mbeki report on Illicit Financial Flows during an interactive session with journalists at the event, the Vice President called for concerted efforts among African leaders and cooperation between Africa and multilateral organisations to end the scourge of Illicit Financial Flow from the continent.

On the proposal to combating Illicit Financial Flows by the Organisation for Economic Cooperation and Development (OECD), Osinbajo said there was need for adequate representation of Africa during negotiations about illicit funds and their proceeds.

For his part, the Secretary General of UNCTAD, Dr Mukhisa Kituyi, said the determination of political authorities in Africa to address issues relating to abuse of tax practices, among others would be crucial in tackling illicit flow of resources to havens outside the continent.

Kituyi commended Nigeria for its leadership on the subject matter.

He added that sharing data on trade among African countries and adopting best practices such as the Open Governance Initiative as well as the Extractive Industry Transparency Initiative, would help in tackling the scourge of Illicit Financial Flows.

The publication by the United Nations Conference on Trade and Development (UNCTAD) on the impact of illicit financial flows (IFFs) on development in Africa was designed to broaden the awareness on the scale, scope, and cost of illicit financial flows.

Detail as reported by Laolu Akande

Senior Special Assistant to the President on Media & Publicity

TACKLING ILLICIT FINANCIAL FLOWS: WE MUST PAY PARTICULAR ATTENTION TO REFORM OF INTERNATIONAL TAX SYSTEM, SAYS OSINBAJO AT UN FORUM

*VP urges leaders of destination countries to insist on repatriation of illicit funds & their proceeds

Leading the call for an effective global action against Illicit Financial Flows (IFF) and related vices, which is negatively impacting progress in developing countries especially in Africa, Vice President Yemi Osinbajo, SAN has called for an overhaul of the international tax system in order to tackle the scourge.

The Vice President made the call on Monday at the virtual press launch of a publication by the United Nations Conference on Trade and Development (UNCTAD) on the impact of illicit financial flows (IFFs) on African Development.

According to Prof. Osinbajo, “the enormity of efforts required to tackle illicit financial flows is evident in the many dimensions the scourge presents itself. It manifests through harmful tax policies and practices, abusive transfer pricing, trade mis-pricing and mis-invoicing illegal exploitation of natural resources as well as official corruption, and organized crimes. We have to pay particular attention to efforts to reform the international tax system.”

Continuing on the need for an effective reform of the system, the Vice President said “…the commercial form of illicit financial flows especially tax evasion and aggressive tax avoidance accounts for up to 65% of illicit financial flows. This means that we must pay particular attention to these issues which are aided by things such as tax treaties, tax havens, and financial secrecy jurisdictions and indeed tax competition which leads to a ‘race to the bottom’ in terms of tax rates amongst developing countries.”

Calling for an urgent global action, the Vice President said leaders of destination countries of illicit funds and their proceeds must demonstrate the will to tackle the menace.

He said “another important issue that we must pay attention to is the identification and return of proceeds of illicit financial flows back to countries of origin as an effective deterrent to the scourge of illicit financial flows. Certainly, exposing those involved in practices that facilitate illicit financial flows, and retrieving proceeds of illicit funds are efficacious in deterring perpetrators, rebuilding the confidence of the citizenry, and compensating for the damage caused by such crimes.

“I encourage all leaders, whose countries are considered absolute outliers for illicit financial flows, to join forces and take the responsibility of combating the scourge by insisting on the repatriation of illicit funds and their proceeds.

“Let me also avail myself of this opportunity to call on leaders, whose countries are the main destinations for illicit financial flows, to take concrete steps to prevent and stop the receipt of illicit funds into their countries, and to assist in freezing, seizing, and returning such funds and its proceeds already in their countries”.

On the way forward, the Vice President called for cooperation and synergy among “the private sector, civil society, trade unions and professional groups to work with governments in tackling illicit financial flows.”

His words: “The private sector must support our efforts by adhering to international best practices in their operations and by ensuring that their tax and trade practices comply with local laws while professional bodies, including those for lawyers, accountants, auditors, and bankers must observe ethical professional standards and hold their members to account if they abet tax evasion and aggressive tax avoidance.”

While appreciating the immediate past President of the United Nations General Assembly, Prof. Tijjani Muhammad-Bande, and Amb. Mona Jul of the Economic and Social Council (ECOSOC), for taking the initiative to establish the first global Financial Accountability, Transparency and Integrity Panel (FACTI Panel), Prof. Osinbajo called on the United Nations system to facilitate the establishment of clear rules and enforcement mechanisms on all aspects of illicit financial flows.

Making reference to the Mbeki report on Illicit Financial Flows during an interactive session with journalists at the event, the Vice President called for concerted efforts among African leaders and cooperation between Africa and multilateral organizations to end the scourge of Illicit Financial Flow from the continent.

Answering a question on the proposal on combating Illicit Financial Flows by the Organisation for Economic Cooperation and Development (OECD), the Vice President said there is need for adequate representation of Africa during negotiations about illicit funds and their proceeds.

In his remarks at the event, the Secretary General of UNCTAD, Dr Mukhisa Kituyi said the determination of political authorities in Africa to address issues relating to abuse of tax practices, among others would be crucial in tackling illicit flow of resources to havens outside the continent.

While commending Nigeria for its leadership on the subject matter, Kituyi said sharing data on trade among African countries and adopting best practices such as the Open Governance Initiative as well as the Extractive Industry Transparency Initiative, would help in tackling the scourge of Illicit Financial Flows.

The publication by the United Nations Conference on Trade and Development (UNCTAD) on the impact of illicit financial flows (IFFs) on development in Africa is designed to broaden the awareness of the scale, scope, and cost of illicit financial flows.

Laolu Akande

Senior Special Assistant to the President on Media & Publicity

Office of the Vice President

28th September 2020