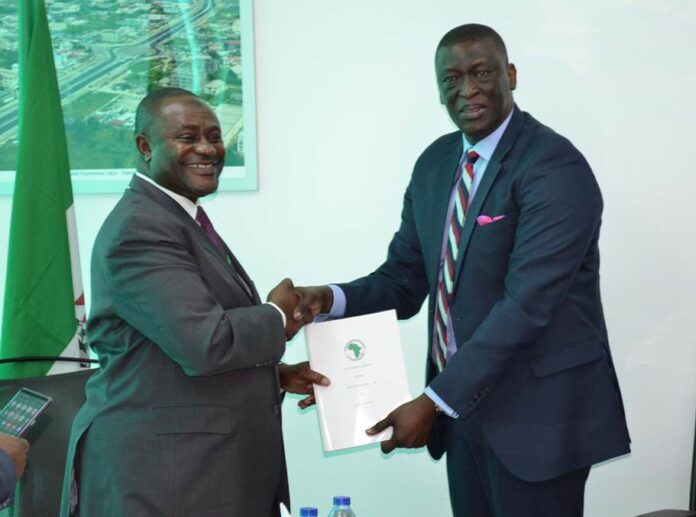

Fidelity Bank has signed a $50 million credit line with African Development Bank (AfDB) to assist women entrepreneurs in their businesses.

The credit is for selected transformative sectors, including almost 100 Micro, Small and Medium Enterprises (MSMEs), in manufacturing, health, and education.

SMEs account for 30 per cent of Fidelity Bank’s loan portfolio.

Mr Mohammed Balarabe, the Deputy Managing Director of the bank, while signing the agreement said the credit facility was fully dedicated to financing MSMEs, with a minimum of 30 per cent going to women-owned enterprises.

“In Africa, a lot of production activities happen by women but because it goes under the radar, nobody seems to be taking notice of it, but Fidelity Bank has done a lot in identifying such.

“This facility will give us the impetus to do more and get more and more women to be capture under the scheme,” he said.

Balarabe further said the facility would also help the bank in meeting the demand for medium-term funding to players in the target sectors and contribute to improved quality of lives, job and wealth creation and tax-revenue generation.

He said that Fidelity had turned around the MSMEs sector, which had been abandoned by the banking sector over the years due to lack of adequate knowledge.

“What we have been able to do is that we have created a division to promote MSMEs in such a big way that it has constituted a major activity in our bank.

“Today, we pride ourselves in saying that, we are one of the leading financial institutions in Nigeria, working directly with the MSMEs, and our approach is so unique.

“It is not all about just putting money behind MSMEs, but we go the extra mile to research and understand their mode of business, and more importantly, come up with ideas that will help them to succeed.

“We find out that the mobility rate of MSMs in Nigeria (indeed the whole World over), is so high, but because of our approach and the platform provided for them, the MSMEs are succeeding”, he said.

Balarabe thanked AfDB for working so hard to bring the agreement to fruition, looking forward to a strong partnership between both organisations.

Responding, Mr Ebrima Faal, a Senior Director/Country Representative at AfDB office in Abuja said that the agreement would impact positively on the MSMEs and through them have impact on Nigerian communities.

“We are counting on you to make sure the conditions for loan disbursement are quickly met so that we can quickly start disbursement to targeted beneficiaries”, he said.