Comercio Partners has advised the Central Bank of Nigeria (CBN) to initiate a pilot stage of its e-Naira as a necessary first step before a full-scale launch of its digital currency in October.

The report considered the pilot stage as a critical element of the successful full launch of the digital currency.

“While implementing the e-Naira and a digital wallet (DW) has the potential to bring numerous benefits to the Nigerian economy and its major stakeholders, including citizens, businesses, and all levels of government, a test run would seem a more appropriate action to take.”

It noted that 14 countries out of the 81 countries pursuing digitalization of their legal tender, including major economies like Sweden and South Korea, are now in their pilot stages and preparing a possible full launch.

The Comercio Partners noted that “when the governor of the CBN announced plans to introduce a new digital currency to the Nigerian monetary system at the MPC meeting in July, we assumed it was one of those far-fetched ideas that would necessitate extensive planning and technological infrastructure.

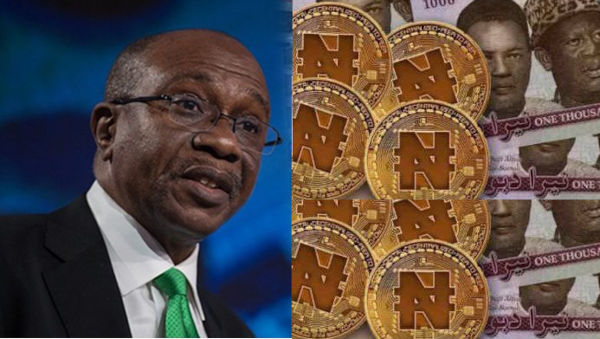

“Well, we guess that we were wrong. In a recent press statement, the CBN stated its plans to launch its Central Bank Digital Currency (CBDC) pilot scheme called the eNaira on October 1, 2021, with Bitt Inc, a financial technology company that utilises blockchain and distributes ledger technology to facilitate secure peer-to-peer transactions, as a technical partner.”

The report described the CBDC as the digital form of a country’s fiat currency that is also a claim on the central bank issuing electronic coins or accounts backed by the full faith and credit of the government.

It also clarified that the CBDC in two major aspects are not the same as the cryptocurrency that most people are all familiar with.