The Central Bank of Nigeria (CBN)

says the Nigeria-China currency swap deal will not cover the importation of the

41 items already blacklisted from the official foreign exchange.

says the Nigeria-China currency swap deal will not cover the importation of the

41 items already blacklisted from the official foreign exchange.

Isaac Okorafor, Acting Director, Corporate

Communications, at the bank, made this known in an interview with NAN on Sunday.

Communications, at the bank, made this known in an interview with NAN on Sunday.

He said this will ensure the currency deal does not stifle local companies and make

Nigeria a dumping ground for Chinese goods.

Nigeria a dumping ground for Chinese goods.

In 2015, the bank said it would not provide forex for the importation

of 41 items to ensure efficient utilization of forex and encourage

local production.

of 41 items to ensure efficient utilization of forex and encourage

local production.

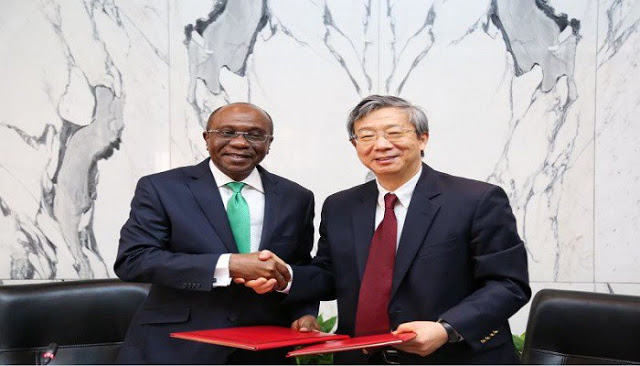

The CBN recently signed a bilateral currency swap

agreement with the People’s Republic of China worth N720 billion.

agreement with the People’s Republic of China worth N720 billion.

Some of the items banned were rice, cement,

poultry, tinned fish, furniture, toothpicks, kitchen utensils, tableware,

textiles, clothes, tomato pastes, soap and cosmetics.

poultry, tinned fish, furniture, toothpicks, kitchen utensils, tableware,

textiles, clothes, tomato pastes, soap and cosmetics.

“We are going to focus on exports to China. Also,

remember that we already export cassava products to China as well as leather,

hides and skin to China amongst others.

remember that we already export cassava products to China as well as leather,

hides and skin to China amongst others.

“So this deal will open further the export market

to China. Also, I want Nigerians to know that the items that will come in are

not necessarily finished goods, so the issue of Nigeria becoming a dumping

ground for China does not arise.

to China. Also, I want Nigerians to know that the items that will come in are

not necessarily finished goods, so the issue of Nigeria becoming a dumping

ground for China does not arise.

“This is because the 41 items that had initially

been banned from the Nigerian foreign exchange market will still not qualify

under the deal.

been banned from the Nigerian foreign exchange market will still not qualify

under the deal.

“The exchange of currencies between the Nigerian

Central Bank and the Chinese Central Bank will make it easier for our

entrepreneurs to have direct access to foreign exchange in Renminbi.

Central Bank and the Chinese Central Bank will make it easier for our

entrepreneurs to have direct access to foreign exchange in Renminbi.

“Before now, when importing necessary machinery or

merchandise from China, you first exchange Naira for the dollar before changing

it again to Renminbi and this puts pressure on the Naira.

merchandise from China, you first exchange Naira for the dollar before changing

it again to Renminbi and this puts pressure on the Naira.

“Now what it means is that a large portion of the

demand for dollars in Nigeria has been lifted off the back of the Naira and put

directly on the Chinese Renminbi.

demand for dollars in Nigeria has been lifted off the back of the Naira and put

directly on the Chinese Renminbi.

“And so it is a positive development as it will

enhance the value of the Naira and reduce our dependence on the dollar for

imports.”

enhance the value of the Naira and reduce our dependence on the dollar for

imports.”

The CBN spokesman said the two central

banks are still working on the exchange rates between the Naira and

Renminbi.

banks are still working on the exchange rates between the Naira and

Renminbi.

According to him, Nigerian entrepreneurs will be

able to access Renminbi through money deposit banks, using similar rules for

the dollar but a clearing bank would be appointed for the transaction.

able to access Renminbi through money deposit banks, using similar rules for

the dollar but a clearing bank would be appointed for the transaction.

He said one of requirements for the appointment was

that the bank must have a branch in China, which some Nigerian banks already

have.

that the bank must have a branch in China, which some Nigerian banks already

have.

“Chinese investors are interested in setting up

shop here. And that is because if they produce here, it will be better for

them.

shop here. And that is because if they produce here, it will be better for

them.

“The cost of transportation, shipping, and all

that, will be eliminated. We have a good environment, so a good number of them

are interested in setting up production lines here.

that, will be eliminated. We have a good environment, so a good number of them

are interested in setting up production lines here.

“Also, when they do that, they are not going to

employ only Chinese workers. A greater portion of the job opportunities in

these plants will be filled up by Nigerians. So for us, it’s a good deal.”

employ only Chinese workers. A greater portion of the job opportunities in

these plants will be filled up by Nigerians. So for us, it’s a good deal.”