Tanko Mohammed

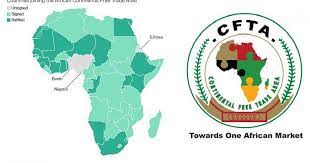

After 38 countries’ ratification of the agreement on African Continental Free Trade Area (AfCFTA), the continental bloc has kick-started pilot phase of the central payments and settlement market infrastructure.

Tagged, “Pan African Payment and Settlement System (PAPSS)’’, the business transaction and payment method in the implementation of AfCFTA is being experimented in six West African countries.

PAPSS is a centralised payment and settlement market infrastructure for processing, clearing and settling of intra-African trade and commerce payments.

The 55-member states of the Africa Union (AU) established the AfCFTA to create a single continent-wide market for goods and services and to promote the movement of capital and natural persons.

On January 1, 2021, AfCFTA implementation officially came into force to deepen economic integration and promote single market of goods and services on the continent.

“We are still waiting for others to ratify the agreement,’’ Mr Wamkele Mene, the Secretary-General AfCFTA Secretariat in Accra, Ghana, told the media in Abuja on Wednesday.

“But I am not worried that we are about 38 because in ratifying any international instrument, processes including legal and political processes needed to be followed for a country to be in a state of readiness.

“There are countries that are ready with custom’s infrastructure that is required to be able to trade in a commercial and meaningful sense, examples are South Africa, Egypt, Ghana and Kenya.

“These are countries that have introduced the necessary customs procedures for the trading to start happening,” he noted.

Mene noted AfCFTA was at the initial stages of the implementation, and also negotiating outstanding areas of the phase one which comprised trade in goods and services and that phase two negotiation which would start either in July or August would focus on intellectual property rights, competition policy, women in trade and digital trade.

He said that the aim was that by 15 years from now, 97 per cent of products traded in Africa should be at zero duty, an ambition which would boost intra Africa Trade by reducing barriers to trade.

“I think Africans should be patient and understand that we are in the initial stages of significance to go together under a single set of rules.

“We will learn from the experience of European Union (EU) that it has taken the EU 72 years to get to this point of market interventions that it enjoyed today.

“What we are doing is not an easy task, it is time consuming, it requires patience to see results in years to come.

“I am not worried about the slowness because typically negotiations and implementation of trade agreement is not something that happens overnight,” he said.

According to him, the AU Assembly of Heads of States and Government give us six months to conclude the outstanding work, we have made a lot of progress.

He expressed confidence that when the head of states convened again in July in Chad, the secretariat would be able to report its conclusion on the task they gave for phase one while ready to start phase two.

Interim Governing Council of PAPSS met in December 2020 in Cairo on the operationalisation of the payment system which was developed by African Export-Import Bank (Afreximbank).

Mene said that the system which would be ready at the end of 2021 was the first major step taken in addressing some challenges related to the cost of currency convertability under AfCFTA implementation.

“We have started a piloting phase of the Pan-African payment and settlement platform of six countries in West Africa who have switched on to the platform.

Transactions are already happening within these six countries that are at an advanced stage of the pilot project.

“So, the platform will make a significant contribution and our estimate is that it will reduce the cost of transactions by five billion dollars annually, being the aggregate amount that is spent on currency convertibility,” he said.

Mene explained that Africa has 42 currencies and the cost of the currency convertibility was actually a constraint to intra Africa Trade.

“When the system is fully up and running, you will be able to transact with somebody in Kenya in Naira and they will receive Kenya shillings and Afreximbank will be the correspondent facility.