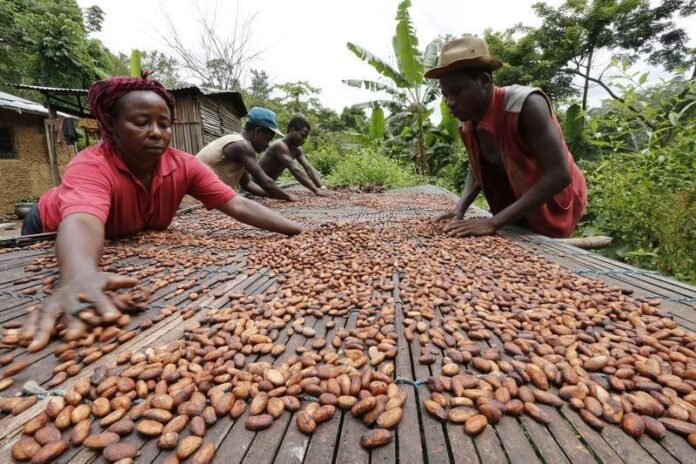

Farmers in top cocoa grower Cote d’Ivoire say the current crop is worsening, with beans starting to rot, as lack of financing prevents them from properly fermenting and drying beans already stressed by bad weather.

Front-month New York cocoa futures traded on ICE have risen nearly 15 per cent since the start of December, mainly on worries over consistently dry weather in Ivory Coast, traders said.

The conditions were brought on by seasonal Harmattan winds that sweep in sand from the Sahara, which can ravage cocoa pods and sap soil moisture, leading to smaller beans.

Financing of cocoa bean purchases and exports is vital to Ivory Coast, the world’s largest producer, with an annual yield of about 2 million tonnes, or about one-third of the world’s cocoa.

Farmers say that banks which arrange financing for farmers and middlemen known as pisteurs, who purchase beans from farmers to sell to exporters, have pulled back on funding in the wake of the bankruptcy of the country’s largest exporter.

That has left farmers unable to care for their plantations or combat the degradation of their beans.

“I have to put the fertilizer once a year and spray the field three to four times a year each quarter. But I can not do it because I have no money,” said Etienne Koidja, a farmer in San Pedro, Ivory Coast.

“Pisteurs and exporters who were helping us also have no money because the banks did not finance.”

Banks have reduced financing for smaller exporters in the wake of the collapse of SAF-Cacao in July. Ivorian banks have struggled to get paid for loans to exporters during the country’s 2016/17 season, which was also marred by crisis.

With local exporters not able to send products abroad, ports are letting shipments of the commodity sit and therefore deteriorate further.

“Cocoa arriving at the ports and not being shipped out could end up becoming damaged because storage facilities in Ivory Coast are not that ideal for cocoa,” a U.S. commodities broker said.

The director of an international export company in Abidjan, who was not authorised to speak on the record, said the company rejected beans in December and January because the quality did not meet expectations.

“The banks stopped financing exporters who could not finance middlemen and buyers who also could not help farmers. It is a chain and when a link is broken, the whole chain is broken,” the director said.

Scarce rainfall and dry winds have even raised concerns about the forthcoming April-to-September mid-crop, farmers said.

Since the end of December, spot cocoa prices in New York and London have steadied as investors await results from global cocoa grind figures, due by the end of January.

“We are continuously hearing the cocoa is not up to the high standards. Because of that, the market is repricing higher, recognizing less than ideal quality,” said Shawn Hackett, president of Hackett Financial in Boca Raton, Florida.

Prices could rise if global cocoa grind figures, a measure of demand, exceed market expectations, a U.S. trader said.

Changing weather patterns could help. Chances of an El Niño weather pattern remain high, which would bring more intense heat and dryness to Ivory Coast cocoa growing regions, a bullish signal, said Peter Mooses, a senior market strategist at RJO Futures.

“Hot weather, dry weather and more winds are all bullish for prices and negative for production,” Mooses said.

Cocoa farmers complain of worsening beans

RELATED ARTICLES