Many African nations looking to restructure debt with China on the eve of a major Beijing summit provides a reality check for the continent, where most countries still view Chinese lending as the best bet to develop their economies.

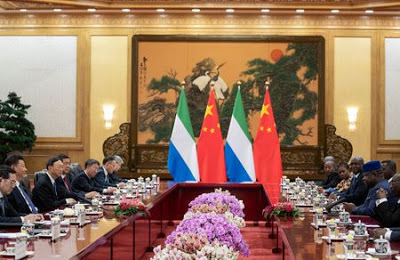

China has denied engaging in “debt trap” diplomacy, but President Xi Jinping is likely to use next week’s gathering of African leaders to offer a new round of financing, following a pledge of $60 billion at the last summit three years ago.

Ethiopia and Zambia, heavy borrowers from China, have expressed desire to restructure that debt, while bankers believe Angola and Congo Republic have already done so, though details of such deals are sparse.

The International Monetary Fund says Cameroon, Ghana and others face a high risk of debt distress, as does Djibouti, whose main source of foreign loans is China, the Fund says, and which holds the majority of external debt.

But many countries, even those heavily indebted to China, still say Beijing offers far better terms than Western banks, and that European nations and the United States fail to match its generosity.

“Especially when you go to multilaterals, it takes such a long time,” Aboubakar Omar Hadi, chairman of the Djibouti Ports and Free Zones Authority, told Reuters.

To develop its Doraleh Container Terminal, Djibouti borrowed $268 million from seven banks at 9 per cent over nine years, he said.

By comparison, its first Chinese loan was $620 million over 20 years at 2.85 per cent, and it came with a seven-year grace period.

“Where is America?” he asked. “Where is the investment from Europe? We are ready. Why are they leaving the whole continent for China? They have themselves to blame if here they are out of the game.”

Chinese officials have vowed to be more cautious to ensure projects are sustainable.

China’s push to cut debt at home, and the cooling of its economy, will affect “non-urgent projects”, said Yang Baorong, an expert on African debt at the Chinese Academy of Social Sciences.

“The overall trend will not change, but the scale will certainly be different under the current circumstances.”

Chinese-backed infrastructure has not always translated into the kind of economic growth that makes rising debt sustainable and resource-based economies are reeling from a slump in global commodities, said Martyn Davies, managing director of emerging markets and Africa at Deloitte.

“The African states have this naïveté at times that this is somehow free money,” Davies said.

From 2000 to 2016, China loaned around $125 billion to the continent, data from the China-Africa Research Initiative (CARI) at Washington’s Johns Hopkins University School of Advanced International Studies shows.

It is the most significant contributor to high debt risks in three African countries, Congo Republic, Djibouti, and Zambia, CARI said this week.

In most other nations, traditional donors, multilateral agencies and private creditors held significantly higher portions of debt, it added. The last decade has seen a boom in African Eurobond issuance.

Chinese officials say this year’s summit will strengthen Africa’s role in Xi’s “Belt and Road” initiative to link China by sea and land through an infrastructure network with southeast and central Asia, the Middle East, Europe and Africa.

Beijing has pledged $126 billion for the plan.

China defends continued lending to Africa on the grounds that the continent still needs debt-fuelled infrastructure development.

Much of the concern over Chinese debt stems from the different measures of “debt sustainability” used by Beijing and African nations versus Western governments and institutions such as the IMF, said Cheng Cheng, a researcher at the Chongyang Institute of Financial Studies at Beijing’s Renmin University.

“If you are trying to increase your GDP, a 25 per cent debt-to-GDP ratio is not enough for any country,” he said.

But the debt problem is driving a push to transform financing to more investment over loans, he said.

“New instruments are being used to leverage finance from elsewhere, because the Chinese government has long realised that there is generally the debt problem everywhere.”

China’s attraction stems from its ability to offer financing from state-owned enterprises or funds such as the China-Africa Development Fund or its Silk Road fund, besides special purpose vehicles that avoid sovereign debt on balance sheets.

Lubinda Habazoka, president of the Economics Association of Zambia, said that after becoming eligible for heavily-indebted poor country debt forgiveness under the IMF, multilateral agencies advised it to go to the capital markets in future.

“Today, we have found we are spending so much for this debt on capital markets,” he said. “The result is it has become very difficult for countries like Zambia to meet payments for interest.”

China’s lower and longer-term rates make it more attractive for debt refinancing, but the debt pressure has spurred Zambia to seek renegotiation with Beijing, he said.

“We thought no, no, China was going to be soft on us. But unfortunately, that’s not the case.”

Source: The East African