The Central Bank of Nigeria (CBN), on Monday, said that the old N200, N500 and N1,000 banknotes remain legal tender till Dec. 31.

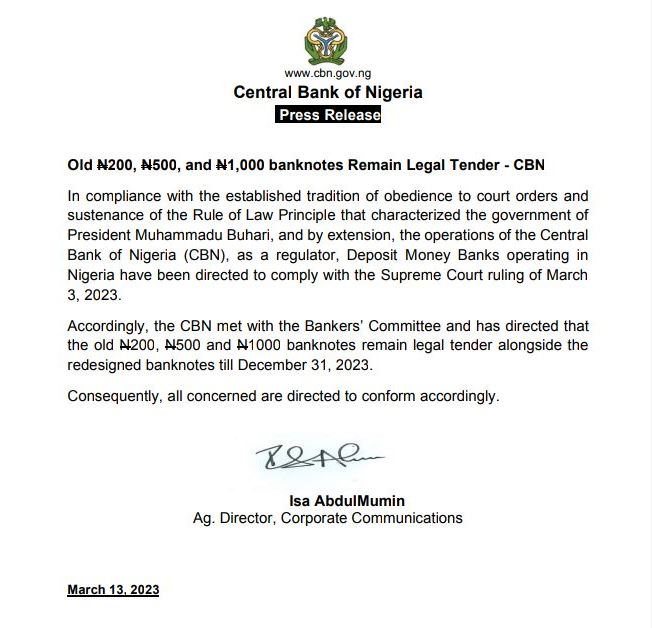

According to a statement by Isa AbdulMumin, CBN’s Acting Director, Corporate Communications, this is in compliance with the March 3 judgment of the Supreme Court.

The apex court, had in the said ruling on March 3, ordered the Federal Government to accept the designated demonstrations of Naira notes as legal tender until Dec. 31.

However, neither President Muhammadu Buhari nor the CBN governor, Godwin Emefiele, reacted to the ruling until when the presidency, in a statement on Monday, absolved the president from non-compliance with the ruling.

According to the statement signed by Malam Garba Shehu, Senior Special Assistant on Media and Publicity to the President, Buhari never told Emefiele and the Attorney-General of the Federation, Abubakar Malami to defy any court order.

“The directive of the president, following the meeting of the Council of State, is that the CBN must make available for circulation all money that is needed and nothing has happened to change the position, ” Shehu said.

AbdulMumin said that the new CBN directive was in compliance with established tradition of obedience to court orders and sustenance of the rule of law principle that characterised the Buhari government.

“Deposit Money Banks operating in Nigeria have been directed to comply with the Supreme Court judgment of March 3.

Accordingly, the CBN met with the Bankers ‘ Committee and has directed that the old N200, N500 and N1,000 banknotes remain legal tender alongside the redesigned banknotes till Dec. 31,” he said.

Reacting to the directive, a financial expert, Prof. Umhe Uwaleke, described it as a welcome development.

Uwaleke, a Professor of Capital Market at the Nasarawa State University, Keffi, however, urged the CBN to reinject the quantity of note withdrawn to address the acute shortage of cash.

“My concern is that except a substantial quantity of already withdrawn notes are reinjected and the cash withdrawal limits eased, the cash scarcity is most likely to persist,” he said.

Meanwhile, Governor Bello Matawalle of Zamfara has described the Central Bank of Nigeria (CBN)’s compliance to the Supreme Court Order on old currency notes as a victory for Nigerians.

Matawalle stated this in a statement issued by Malam Zailani Bappa his

Special Adviser, Public Enlightenment, Media and Communications in Gusau on Monday.

According to Bappa, the Governor believes that the court procedure which culminated into the reversal of the earlier CBN’s rash implementation of the cashless policy is for the good of the Country’s micro-economy and for the wellbeing of the common man.

He quoted Matawalle as saying: “Those who accused us of going to court for the sake of the Presidential elections, even as Nigerians groaned under the policy implementation, are now proven wrong as we did not relent until we succeeded in achieving our demand to its logical conclusion.

“This is way after we have won the said Presidential election.

“All Nigerians can now sigh a relief on this matter, and we expect more cash to be in circulation to ease our pains, while those who were unable to replace their old naira notes with the scarce new notes will no longer lose their hard earned money.”

According Bappa, the Zamfara Governor who seeking re-election in the rescheduled March 18 Governorship and State Assembly poll, commended President Muhammadu Buhari for distancing his administration from any attempt to disrespect the verdict of the Supreme Court on the issue.

He said the governor was expecting all Deposit Money Banks (DMBs) fully comply with the CBN’s directives.

The governor, Bappa noted, admonished the public to fully recognise the value of the old naira notes once again until December 31.