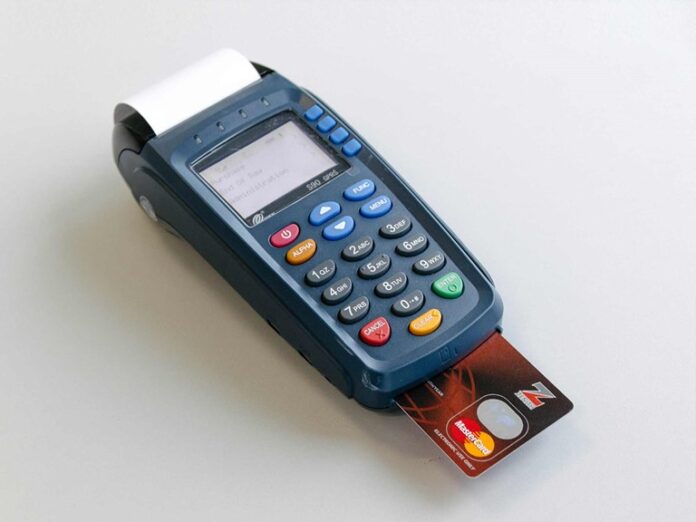

Point of Sale operators (PoS) and traders in Lagos have appealed to the Central Bank of Nigeria (CBN) and network service providers to ensure that the machines function well without interruptions.

The stakeholders made the observation on Thursday in Lagos.

According to them, well-functioning machines become necessary following the apex bank’s directive on withdrawal limits.

They advised the authority to restore people’s confidence in the use of PoS, to enable them to remain in business, now that most operators have increased their charges.

The apex bank had in a new circular issued to banks increased the maximum weekly limit for cash withdrawal across all channels, with effect from Jan. 9, 2023.

The new policy limits weekly cash withdrawal to N500,000 and N5 million for individuals and corporate bodies respectively.

A trader in Oshodi market, Mr Divine Pataya, said that with the new policy and network disruptions, she did not think that she could continue with the business.

“When PoS started, a lot of banks used it to support us; I have four PoS from four different banks, but I had to dump three because I do not get instant alerts to transactions done through the machines.

“For instance, if I have 10 customers buy from me and make payment with the PoS, their monies will not come on that day until the next day.

“When it eventually comes, it will be difficult for me to know who paid what because it will all come in bulk,’ he said.

Another operator, Mrs Uchechi Tunji, said that many times, monies had been wrongly deducted from her account through PoS.

“When you go to your bank to lodge the complaints, the bank will tell you that there is an intermediary that is looking into it. Sometimes, it takes six months to get back your money.

“I think the CBN has a lot of work to do on that, and if the machines that are outside are not too good, they need to give us good and effective ones, as we cannot go to the bank to withdraw a lot of cash again,’’ she said.

Alhaja Rekiyat Suleiman said that poor network had made her to lose a lot of customers.

“They get angry and embarrassed whenever I ask them to wait a while, for me to receive transaction alerts from my bank before they leave with the goods or money.

“I am not enjoying any of the three PoS machines in my store because of transaction decline, due to bad network service.

“The problem is that when customers pay with PoS, the receipts will be printed out and handed to them.

“For the next one hour, you will not receive transaction alert, and you will not want to release the goods. This has really affected my business, it is painful and embarrassing to the customer and has made people to not trust the system,’’ Suleiman said.

Meanwhile, Mrs Zainab Abdulmumini from the Consumer Protection Department, CBN, had said during a sensitisation tour of the Balogun Market, Lagos, on the newly redesigned naira notes that one of the core functions of the CBN was to promote a sound financial system.

She said that the duty of the Consumer Protection Department of the CBN was to protect consumers and traders, to also ensure that they were not being exploited by their banks.

According to her, three divisions in Consumer Protection Department are being saddled with the responsibility of educating the people: Consumer Education Division, Complaint Management Division and the Market Conduct Division.

“So, first thing to do when you have a transaction issue is to meet your bank, tell them your problem and ensure you have a tracking ID from your bank.

“If your bank is not really doing anything about it, or your bank has done something about it and you are not okay with it, come to CBN’s Consumer Protection Department.’’

She said that accessing the Consumer Protection Department was not difficult.

“You could reach them by sending a mail to CPD@cbn.gov.ng, or walk into any CBN branch in the country.

“You have a right to walk into the Information and Client Office to lodge complaints, you can write a letter to the Director, Consumer Protection Department, submit it in Abuja or in any branch of your choice, it will be handled free of charge,’’ Abdulmumini said.

She urged consumers to know their responsibilities as it was important.