Economic experts have urged the Federal Government to seek debt moratorium and reduce the cost of governance to reduce funds expended on debt servicing.

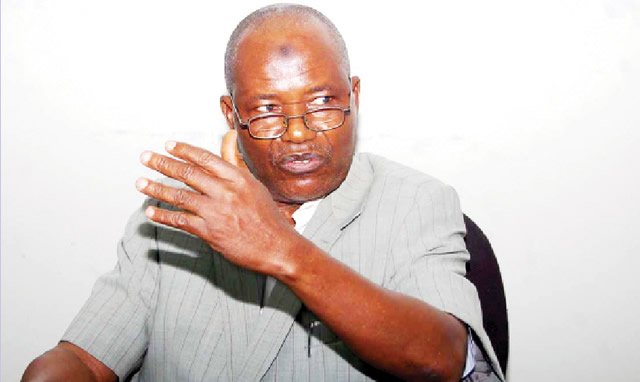

The Head of Department of Economics, Olabisi Onabanjo University, Prof. Sherifdeen Tella, Ago Awoye, Ogun State, said the Federal Government should demand for debt moritarium from our development partners.

He said in Lagos on Tuesday: “Asking for a moratarium is the best because it will enable government to suspend payment for now and restrategise.

“The government cannot continue to service its rising debt profile at the expense of meeting the competing needs of the people,” he said.

He noted that requesting debt a moratorium was vital because it would ensure government to plan and invest in productive sector of the economy.

Tella added that the Federal Government should desist from borrowing and creatively look inwards the economy.

“The authorities should charge the ministries, departments and agencies of the government to be innovative in generating funds.

“Particularly, the money-spinning ones, to block all leakages and automate their operations so as to raise funds,” he said.

Dr Uju Ogubunka, a former Executive Secretary, Chartered Institute of Bankers of Nigeria (CIBN), said that spending huge percentages on debt servicing was unbelievable.

“Spending huge sums on debt servicing will put unnecessary pressure on government revenue.

“This simply means that the government revenue position is quite critical and providing public goods might be negated,” Ogubunka said.

He noted that the Federal Government should reduce the cost of governance to curb cost.

“Cutting down the high cost of public officeholders is crucial to reducing the paraphernalia of their office.

“We expect that by now the Federal Government ought to have implemented the Steve Oronsaye report so as to reduce cost,” he said.

He noted that the Federal Government could enhance its earnings by a total removal of petroleum subsidy.

International Monetary Fund (IMF) has said the Federal Government could spend as much as 92.6 per cent of its revenue on debt servicing this year.

It also estimated last year’s debt servicing-to-revenue ratio at 85.5 per cent.

As of the end of September, 2021, debt-servicing-to-revenue ratio stood at 76 per cent, implying that 76k out of every N1 earned by the government was spent on payment of interest on debts.