Vice President Yemi Osinbajo has urged financial market experts to support government’s efforts, by developing an appropriate housing finance model that will significantly transform the housing sector on a large scale.

Osinbajo’s spokesman, Laolu Akande, in a statement on Monday in Abuja, said the vice president was spoke when a delegation from the Financial Markets Dealers Quotations (FMDQ), led by Mr Bola Onadele, its chief executive officer, who paid him a courtesy visit at the Presidential Villa.

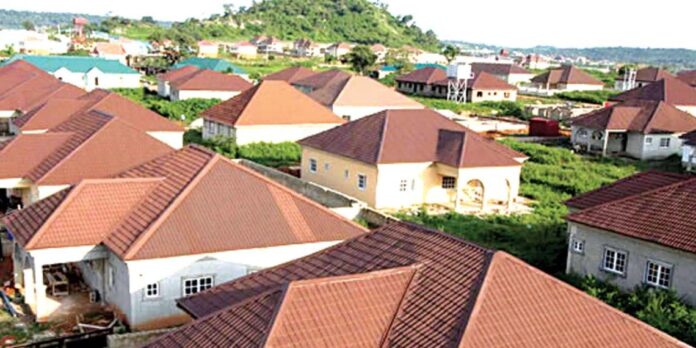

Economic experts estimate Nigeria’s housing deficit at between 18-22 million units, while the ratio of mortgage finance to GDP in the country is only 0.5 per cent, as against 31 per cent in South Africa and 2 per cent in Ghana and Botswana, respectively.

Osinbajo said that he strongly believed that if Nigeria was able to unlock the conundrum in the housing sector, it could get things working.

“In our Economic Sustainability Programme (ESP) we have something on social housing, but one of the critical issues is in how to market the houses, how we are able to provide the finance so that people can afford to buy them.

“These are houses that are in the order of about N2 million or N2.5 million, but there are still constraints on account of the fact that we just do not have

anything like a feasible housing finance model; I think it is time for us to do so.

” It just looks like it has always escaped our capacity to find a real solution to the problem”, the vice president said.

On the possibility of having a model that would work, Osinbajo said that everyone recognised that Nigeria was facing very challenging times, however, the sheer range and vastness of Nigeria’s potential has made it seem almost intuitive that it was bound to succeed.

“I have no doubt in my mind whatsoever, that given the right mix of policy initiatives, we can get these things done.

“And your characterisation of what needs to be done like attracting capital and sustaining it, is so important because ultimately capital will go where it is best treated.

“And, if we are able to attract it because we have the market, we have everything going for us, even in the worst of times, despite the situation, you find that there is still a great deal of interest.”

Onadele, had earlier, said the visit was to inform the vice president about the transformation taking place in the FMDQ and the need for government support in growing the financial market for the benefit of Nigerians and the economy.

He applauded Federal Government’s efforts in creating an enabling environment for the transformation to occur, citing housing finance and mobilising capital for projects in the transportation sector, among others, as key areas of interest for investment by the market.

FMDQ is Africa’s first vertically integrated financial market infrastructure (FMI) group, strategically positioned to provide registration, listing and quotation services, and is owned by the Central Bank and commercial banks in Nigeria.

Osinbajo also met at Presidential Villa, stakeholders in Nigeria’s oil and gas industry under the auspices of Independent Petroleum Producers Group (IPPG).

The group commended the vice president’s peace efforts in the Niger Delta in 2016, that ensured peace and security of investments in the region at a time when the nation was suffering a recession.

Chairman of IPPG, Mr Abdulrazak Isa, noted that Osinbajo had been a great supporter of the association, recalling that years ago, his unprecedented intervention helped in resolving the security situation in the Niger Delta region.

“Since that time, we have not recorded one incident of attack on our facilities,” he said.

He solicited the support of the Federal Government in securing investments in the sector, saying that the IPPG would replicate the vice president’s 2016 crisis resolution model, to address emerging security threats on oil and gas facilities in the southeast.

Also speaking, the immediate past president of the group, Mr Ademola Adeyemi-Bero, added that since Osinbajo’s intervention in oil-producing communities in Delta, Rivers, Akwa Ibom, Edo, Bayelsa, Imo, Abia and Ondo, there had not had any shutdown of facilities.