Banks and Financial Technology (FinTech) operators have been urged to leverage technology such as Artificial Intelligence (AI) to remain competitive.

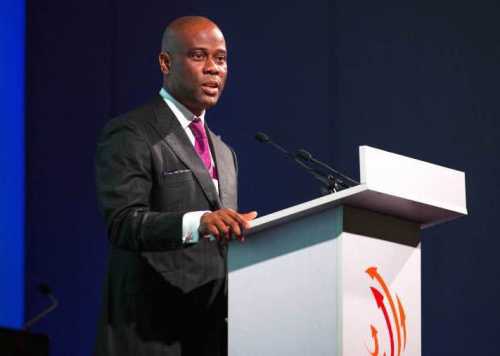

Herbert Wigwe, Chief Executive Officer, Access Bank, gave the advice in Lagos during the Africa FinTech Foundry (AFF) Disrupt 2019 conference, powered by Access Bank.

The theme of the conference is ”Digital Gold Rush: Building a Sustainable Tech-Economy”.

“Leveraging such technology as artificial intelligence and utilising data analytics is imperative if banks and Fintechs are to remain competitive.

“Today, becoming an intelligent bank is not an option, it is a necessity, as technology is redefining the way banks operate,” Wigwe said.

He said that AI, Big Data, Cloud Computing, Virtual Reality, robotics, Cryptocurrency – all brought enormous opportunities for banks to significantly improve the way customers’ access and manage finances.

According to him, with automation technology, banks and Fintechs are able to grant credit in seconds.

He said that a manual review of 12,000 documents used to take 360,000 hours, but today, this could be done in seconds using AI.

The chief executive officer said that blockchain could be used to execute smart contracts, eliminating manual costs of transactions.

He said that robotics technology was used to serve customers in banks, and there was so much that could be done with data, as big data analytics helped an intelligent bank understand its customers.

Wigwe said that from a business perspective, and with the benefit of hindsight, traditional banking environment did not provide opportunities for scalability.

He said most years, it was business as usual, as banking processes were manual and in-branch, creating the need for brick and mortar branches with their expensive overheads, and in the case of Nigeria, low level of financial inclusion.

“Technology has changed everything. Not only is this continuing, the rate of development and evolution is speeding up exponentially.

“Technology-driven financial institutions will disrupt traditionally-run banks by taking advantage of any inherent weaknesses in their business models.

“They will do this by offering better value propositions to their customers.

“Today, it is our task to brainstorm these weaknesses and uncover opportunities in our current business models that technology will help us solve.

“Today is a gathering of the best technology brains ready to re-define the future of intelligent banks and Fintechs and create new disruptions for our industry,” Wigwe said.

Segun Adeniyi, Head of AFF, said that the evolution of technology and the 4th Industrial Revolution were about opportunities.

Adeniyi said that it was about using the power of technology to harness the opportunities that was available in Africa.

“We aim to help innovators harness the power of their innovations, give them platforms to test and go to market.

“We provide them with unparalleled access to global financial, technology, business and investor partner networks,” he said.