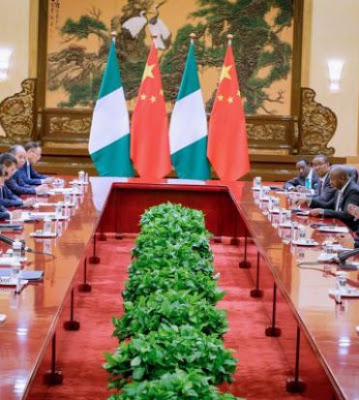

Nigeria’s Debt Management Office (DMO)

has given the assurance the the probability of default in repayment of

loans does not arise.

has given the assurance the the probability of default in repayment of

loans does not arise.

He spoke do douse growing concern over the surge in loans taken from China by Nigeria.

DMO dismissed insinuations of possible

takeover of the economy by China in case of failure to repay the

borrowed funds, saying that the possibility of failure did not exist.

takeover of the economy by China in case of failure to repay the

borrowed funds, saying that the possibility of failure did not exist.

“The DMO has observed that there have been various comments in recent times about borrowing by developing countries from China.

The DMO has therefore considered it necessary to inform Nigerians about the government’s borrowing from China,” it said.

The agency explained that loans from

China was in order to take advantage of a cheaper source of finance and

to diversify the sources of borrowed funds.

China was in order to take advantage of a cheaper source of finance and

to diversify the sources of borrowed funds.

“Firstly, it should be

noted that based on need, and subject to the receipt of requisite

approvals, the government may raise capital from several domestic and

external sources to finance

capital projects in order to promote economic growth and development as

well as job creation.

noted that based on need, and subject to the receipt of requisite

approvals, the government may raise capital from several domestic and

external sources to finance

capital projects in order to promote economic growth and development as

well as job creation.

“Regarding external borrowing, the Nigerian government accesses capital from several sources –

multilaterals, such as the World Bank and the African Development

Bank, as well as bilateral loans from various countries such as France

(through the Agence Francaise de Development), Germany (KfW), Japan

(Japan International Cooperation Agency), India

(India Development Bank) and China (China Export-Import Bank).

multilaterals, such as the World Bank and the African Development

Bank, as well as bilateral loans from various countries such as France

(through the Agence Francaise de Development), Germany (KfW), Japan

(Japan International Cooperation Agency), India

(India Development Bank) and China (China Export-Import Bank).

“These loans from multilateral and

bilateral lenders are typically used to finance specific capital

projects across the country. The International Capital Market is another

source of capital.”

bilateral lenders are typically used to finance specific capital

projects across the country. The International Capital Market is another

source of capital.”

“One of the reasons why

Nigeria will raise capital from multilateral and bilateral sources is

because they are concessional, which means that they are cheaper in

terms of costs and more convenient

to service, because they are usually of long tenors with grace periods.

Nigeria will raise capital from multilateral and bilateral sources is

because they are concessional, which means that they are cheaper in

terms of costs and more convenient

to service, because they are usually of long tenors with grace periods.

“Prudent management of the public debt

implies that the government should avail itself of the opportunity to

access concessional loans, which deliver twin benefits of being more

cost-efficient and supporting infrastructural development.

implies that the government should avail itself of the opportunity to

access concessional loans, which deliver twin benefits of being more

cost-efficient and supporting infrastructural development.

“Loans from concessional lenders have

limits in terms of the amounts that they can provide to each country.

This makes it necessary for Nigeria to have several sources for

accessing concessional capital to increase the total amount

available, and also to avoid undue dependence on only a few sources of

concessional funds.

limits in terms of the amounts that they can provide to each country.

This makes it necessary for Nigeria to have several sources for

accessing concessional capital to increase the total amount

available, and also to avoid undue dependence on only a few sources of

concessional funds.

“Borrowing from China Exim is one of such

means of ensuring that Nigeria has access to more long term

concessional loans. Given the country’s infrastructure deficit, which

needs to be urgently addressed, the loans from China Exim,

which provide financing for critical infrastructure in road and rail

transport, aviation, water, agriculture and power at concessional terms,

are appropriate for Nigeria’s financing needs and align properly with

the country’s Debt Management Strategy.”

means of ensuring that Nigeria has access to more long term

concessional loans. Given the country’s infrastructure deficit, which

needs to be urgently addressed, the loans from China Exim,

which provide financing for critical infrastructure in road and rail

transport, aviation, water, agriculture and power at concessional terms,

are appropriate for Nigeria’s financing needs and align properly with

the country’s Debt Management Strategy.”

The DMO assured that Nigeria’s public

debt was being managed under statutory provisions and international best

practices, adding that there was no risk of default on any loan,

including the Chinese loans.

debt was being managed under statutory provisions and international best

practices, adding that there was no risk of default on any loan,

including the Chinese loans.

Thus, the possibility of a takeover of assets by a lender does not exist, the DMO said.

According to the DMO, all the

government’s borrowing in both the domestic and external markets,

including Chinese loans, are all backed by the full faith and credit of

the government rather than a pledge of its assets.

government’s borrowing in both the domestic and external markets,

including Chinese loans, are all backed by the full faith and credit of

the government rather than a pledge of its assets.

It added that loans from China Exim

constituted just one of the sources of multilateral and bilateral loans

accessed by Nigeria and represented only about 8.5 per cent of the

country’s external debt as of June 30, 2018.

constituted just one of the sources of multilateral and bilateral loans

accessed by Nigeria and represented only about 8.5 per cent of the

country’s external debt as of June 30, 2018.