Ant Financial, the payments and financial services arm of Chinese e-commerce giant Alibaba, is expanding to Africa.

In

a partnership with the United Nations Economic Commission for Africa

(ECA) along with the International Financial Corporation, the firm says

it will promote digital financial inclusion

in the continent through investments and technical assistance. The

offering will target smaller businesses and would look to cater to

largely unserved consumers, including displaced people and refugees with

no official documents or identity papers.

a partnership with the United Nations Economic Commission for Africa

(ECA) along with the International Financial Corporation, the firm says

it will promote digital financial inclusion

in the continent through investments and technical assistance. The

offering will target smaller businesses and would look to cater to

largely unserved consumers, including displaced people and refugees with

no official documents or identity papers.

The deal, announced in Addis Ababa last week, is pegged to both the 2030 global sustainable development goals and the African Union’s Agenda 2060,

which seeks to end poverty and improve lives through economic, social,

and technological progress. The ECA said the agreement will help more

people benefit from the recently signed African Continental Free Trade Area (AfCFTA), the largest free-trade agreement since the creation of the World Trade Organization.

which seeks to end poverty and improve lives through economic, social,

and technological progress. The ECA said the agreement will help more

people benefit from the recently signed African Continental Free Trade Area (AfCFTA), the largest free-trade agreement since the creation of the World Trade Organization.

“We

are thinking about what platforms we can put together to ensure that

not only big companies take advantage of the AfCFTA but also small

companies,” ECA executive secretary Vera Songwe said in a statement

announcing the pact made with Ant.

are thinking about what platforms we can put together to ensure that

not only big companies take advantage of the AfCFTA but also small

companies,” ECA executive secretary Vera Songwe said in a statement

announcing the pact made with Ant.

By

looking to Africa, Ant hopes to replicate its tremendous success in

countries including China, India, and the Philippines. The firm, spun

off from Alibaba, runs Alipay, one of the world’s largest online payment

platforms. Valued at $150 billion, topping Goldman Sachs’

$88 billion in market capitalization, Ant has played a big role in

shaping the fintech landscape in an increasingly cashless world. In

June, it expanded into the global remittance market by launching a

cross-border remittance service powered by blockchain technology.

looking to Africa, Ant hopes to replicate its tremendous success in

countries including China, India, and the Philippines. The firm, spun

off from Alibaba, runs Alipay, one of the world’s largest online payment

platforms. Valued at $150 billion, topping Goldman Sachs’

$88 billion in market capitalization, Ant has played a big role in

shaping the fintech landscape in an increasingly cashless world. In

June, it expanded into the global remittance market by launching a

cross-border remittance service powered by blockchain technology.

| Africa’s mobile money transactions are diversifying | |

|---|---|

| Airtime top-up | 58.9% |

| P2P transfer | 24.4 |

| Bill payment | 11.8 |

| Bulk disbursement | 1.9 |

| Merchant payment | 2.8 |

| International remittance | 0.2 |

With its 1.2 billion

people and a collective GDP of more than $2 trillion, Africa offers Ant

the opportunity to tap into a nascent and often neglected market. Even

though fintech startups on the continent are becoming more attractive to investors, large swaths of the low- and middle-income segments remain underserved when it comes to formal financial services. Traditional banking institutions face numerous challenges in this regard, including high-cost models and fees that make it unaffordable for low-income segments, a high preference for cash over digital transactions, and a predisposition toward cooperatives.

people and a collective GDP of more than $2 trillion, Africa offers Ant

the opportunity to tap into a nascent and often neglected market. Even

though fintech startups on the continent are becoming more attractive to investors, large swaths of the low- and middle-income segments remain underserved when it comes to formal financial services. Traditional banking institutions face numerous challenges in this regard, including high-cost models and fees that make it unaffordable for low-income segments, a high preference for cash over digital transactions, and a predisposition toward cooperatives.

The spread of mobile money, however, has helped to ease some of this, with telecom operators embracing innovative practices that allow customers to not only pay bills but also access services including loans, insurance, and savings.

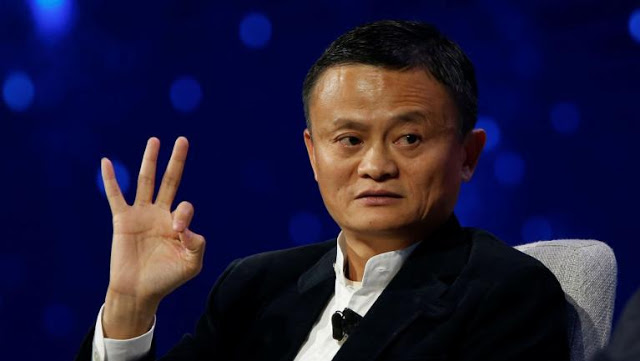

Ant’s entry into Africa also complements its billionaire founder Jack Ma’s vision. Ma visited Africa

for the first time last year, going to Kenya and Rwanda and scouting

for investment opportunities and partnerships to support entrepreneurs.

Last week, he was back on the continent, this time launching a $10 million African innovators fund in South Africa.

for the first time last year, going to Kenya and Rwanda and scouting

for investment opportunities and partnerships to support entrepreneurs.

Last week, he was back on the continent, this time launching a $10 million African innovators fund in South Africa.

Ant’s arrival in Africa follows the plethora of Chinese businesses that have set up shop there, sometimes without state backing, seeking fortunes. Last year, Alipay announced it would launch in South Africa in order to serve Chinese customers visiting the country.

This comes as Sino-African political and economic relations have grown, with increasing diplomatic ties and investments in much-needed infrastructure and trade zones, in addition to technological assistance, military cooperation, and the training of the next generation of African elites.