Djibouti’s reliability as an investment destination following a port grab has been impaired by the recent peace deal between Ethiopia and Eritrea after two decades of deadly impasse.

The investment fortunes of Djibouti have also been put to question following the London Court of International Arbitration’s ruling that the country seizure of control of Doraleh Container Terminal from DP World earlier this year was illegal.

These have dealt a blow to Djibouti, which is already dealing with questions about its mounting debt profile.

It has been a trying few weeks for Mr. Ismaïl Omar Guelleh, President of Djibouti, at a time when most other residents of the Horn of Africa are celebrating emerging peace and, with it, the glimmer of prosperity.

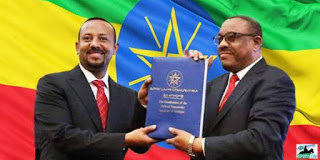

Two old foes Eritrea and Ethiopia have ended 20 years of bloodletting, and even the restive enclaves of Somalia appear ready to reach across the table to former foes in the region.

The war involving Ethiopia had cut off the landlocked country from Eritrea on the Red Sea coast, diverting Ethiopia’s 95 per cent trade to flow through Djibouti’s ports.

The war’s end means Ethiopia has alternative port options in Eritrea once again.

With the current events, “Nationalist interventions in the economy, and weakening political stability indicate that the current mirage of Djibouti’s investment potential is overstated and unsustainable,” says Robert Besseling, executive director of risk consultancy ExxAfrica.

In addition, China was pouring in billions to build a new port and free trade zone, making Djibouti an anchor of Beijing’s strategic “Belt and Road” project. This would put Djibouti at the centre of a grand plan to create a Chinese economic zone that spanned much of the globe.

“Many are dreaming of creating, with Chinese help, something similar to Singapore and the Gulf states,” German publication Spiegel gushed in a Djibouti spread, just last February.

With Eritrea now easing back into the international fold, and its ports once again open to Ethiopia, Djibouti’s logistics value is less certain. The seizing of the DP World’s port concession could not have been worse timed.

Now, potential investors had been put on notice that their capital projects could be taken by Mr Guelleh’s government at any time, Mr Besseling adds.

“Such interventions are likely to deter further foreign investment in the services sector, while Djibouti’s natural resources are negligible.”

Meanwhile, Djibouti must figure out how to deal with the rapidly growing pile of debt it owes Beijing. This is set to grow to around 88 per cent of the country’s overall GDP of $1.72 billion, according to a report published in March by the Centre for Global Development, a US non-profit based in Washington DC.

It is hard not to see a looming similarity with Sri Lanka, which racked up more than $8bn worth of debt to Chinese banks. Most of the money was spent on Chinese contractors who built the Hambantota port, a colossal white elephant as it turned out.

Unable to service the debt, Sri Lanka this year signed over a 70 per cent stake and a 99-year lease to Beijing, which includes 15,000 acres of surrounding land. Perhaps the same fate awaits Djibouti, should it find itself struggling to meet its debt to China.